|

|

Nothing can rock this boat, not a supply gut, not a peace deal or taking out Maduro. Striking a couple of tankers in the Black Sea? 50 cents a barrel.

I was convinced this was a natural part of the cycle, end of year drag, apathy or lack of interest, but as of late, I’m starting to believe it is by design. Bear with me on this one:

And by desing I mean, the market is choosing to ignore all the narratives out there, including the impending oil glut, the rampant product cracks, drones flying overhead, and what have you…with the change in the trading cycle also came a shift in mentality among oil traders, operating in silos and looking at their own backyard rather trying to save the year in the last few weeks of the year, what’s done is done, that PNL is set, better luck next year.

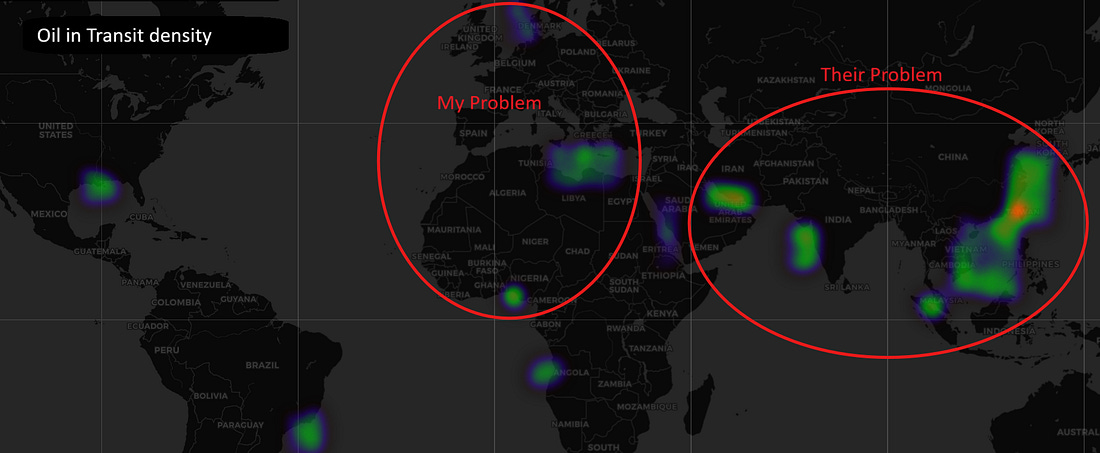

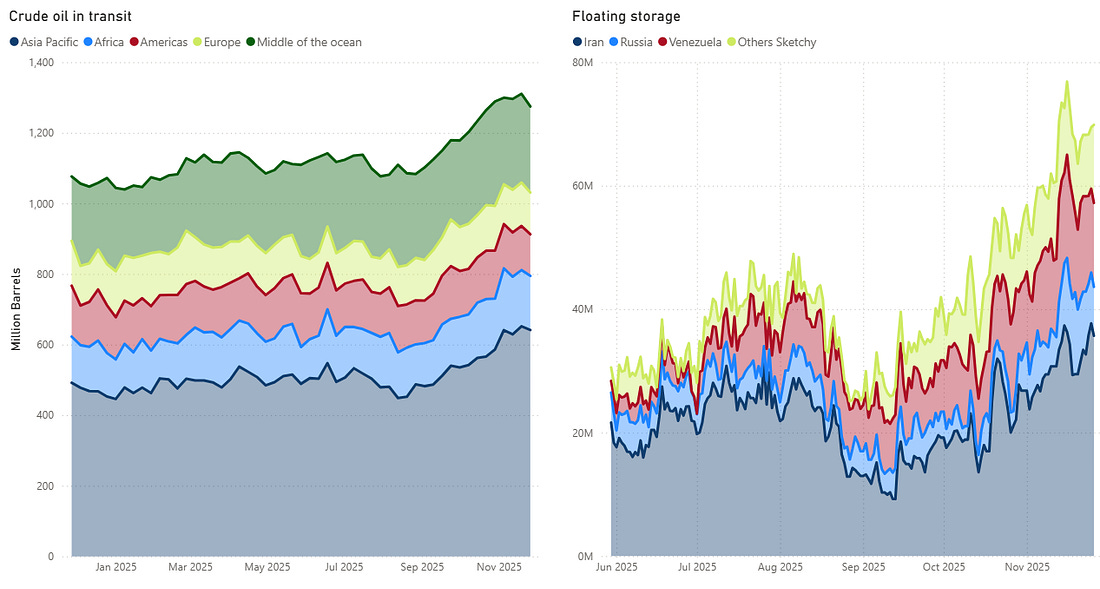

We acknowledge there is a lot of oil slashing around, but that is China’s problem, not mine, I have refineries to feed here and I need the promptest barrel I can get… that certainly has been the motto in the Atlantic last few days. The market is pushing the problem later into the next year. Proof of that is the contango shape that is moving back on the curve as we roll, hoping for a miracle that would clean up that mess that is the floating storage. Of course, we know how that ends, but that will be in next year’s trading book, not now.

As a result, we have a market that is paralyzed and no longer riding on fear or hope, it’s just there waiting for cues, but if flat price doesn’t move, we will find something else that moves. Case in point: Gasoil.

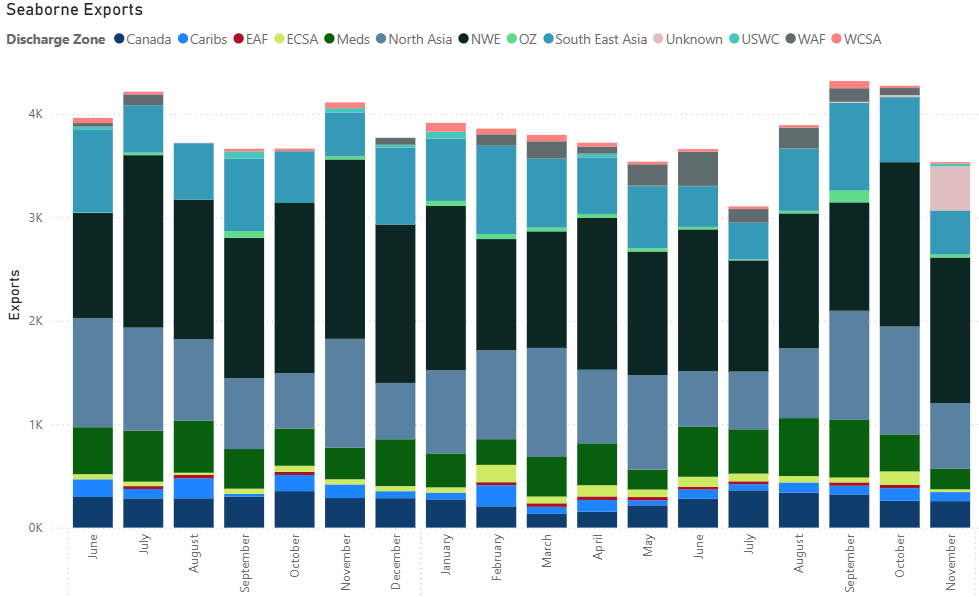

The change in spirit was accompanied by an increase in activity in physical trading, which was expected, given the prior months with all the refineries offline, there weren’t many people to sell oil to, putting those on inventory wasn’t an option, so everyone thought it was a great idea to put those barrels in the water, and beware of all those narratives that say all those floating barrels are sanctioned or OPEC, there are a lot of Atlantic barrels that have sailed a few weeks ago and are being chained from trader to trader with no end buyer (a refinery) picking them up.

Oil Physical

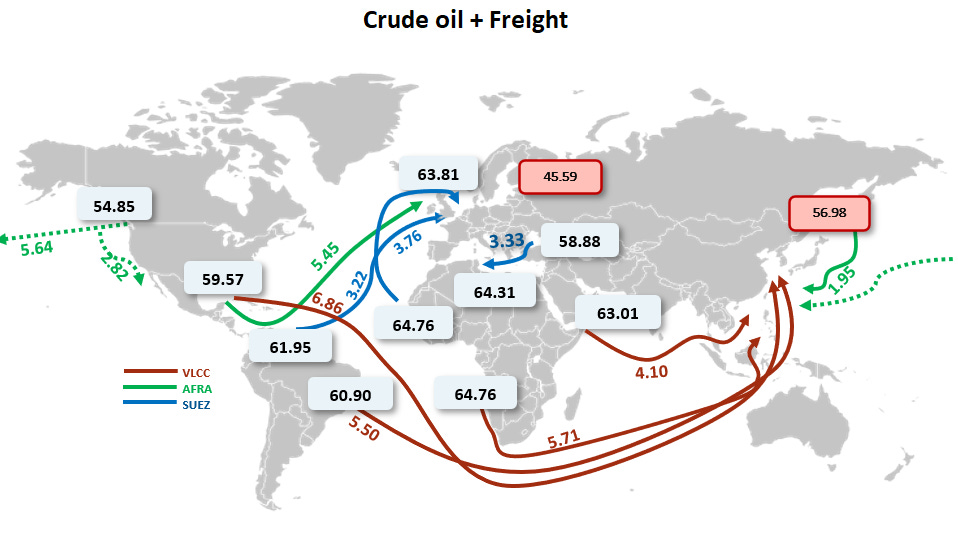

If you are close to a refining hub, you are in luck, if not, get ready to pay up for transport. Speaking West of suez this has been the case with US and North Sea (and some Meds) physical differentials going up steadily, with the ones in WAF and Latam having to make peace with quite a haircut if they want to clear... and even if... those barrels are hard to place.

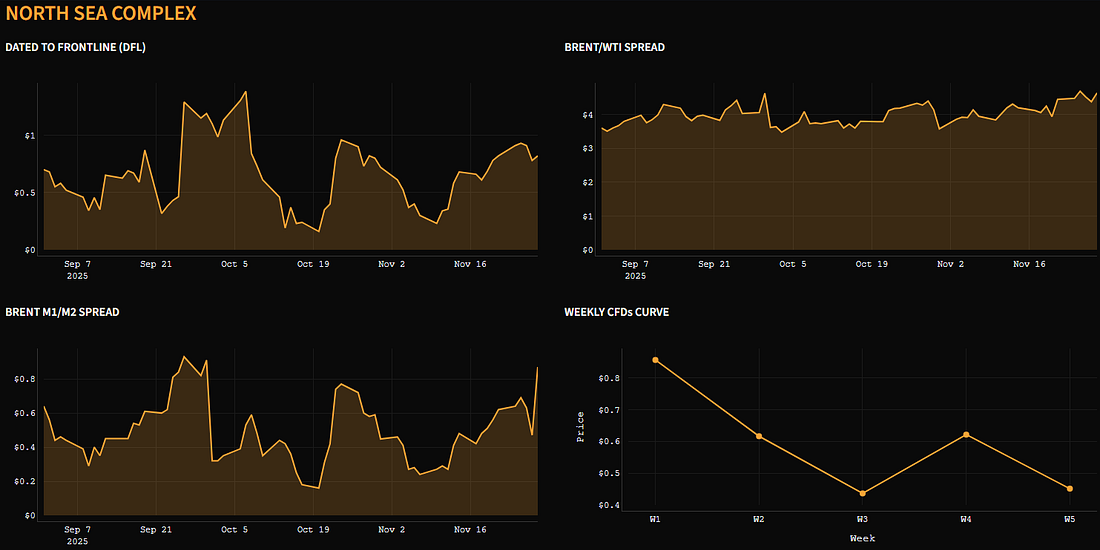

North Sea

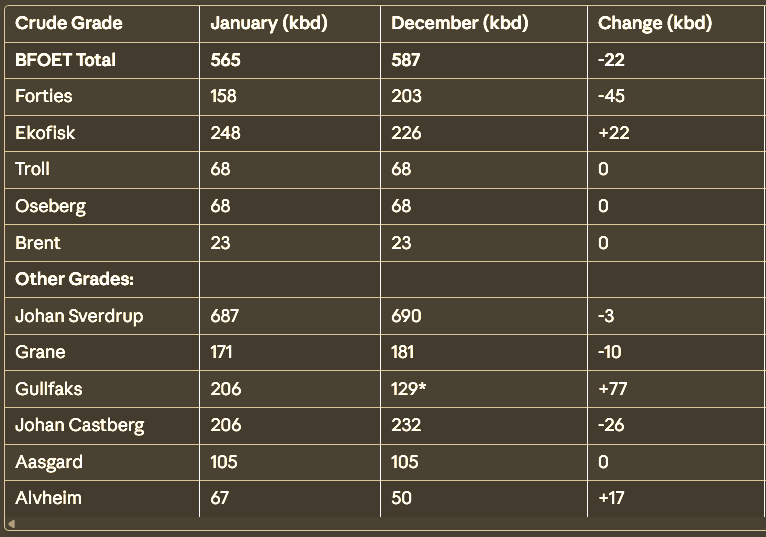

Total optimism. In the last weeks, physical diffs for the North Sea complex went from -1 in some extreme cases, to +0.5 with more activity seen on the window, and by more activity I mean Totsa (Total energies) bidding everything up, taking 6 cargoes this week, mostly Midland cargoes that were chained, but also 1 Forties and 1 Johan Sverdrup. We have seen this kind of play when only one player is lifting the benchmark, and we know how it ends, but on their defense, their Antwerp refinery is quickly ramping up to 230kbd, after 2 months offline. Lavera refinery from PetroIneos is also coming back, Pernis had some flaring events this week, but that means they are running hard, but yes, the big refis in EU are coming back now. We can count with some solid extra 500kbd of demand now.

On the supply side, we still have some issues with Forties maintenance, allegedly December will have 9 cargos and Jan 7, but it is more likely we end up with 8 for each month.

Remember Gunvor? aka the Kremlin puppet? They are lurking underneath, keeping most of the chained cargoes 7 out of 16, so eventually they will come out of the gate and try to push those cargoes in the open because not many people are very keen to keep trading with them after the failed attempt to take over Lukoil assets. Banks are certainly nervous.

So what’s the deal here? People are pointing to mid-January cargoes to suffer a bit, the cfd curve is showing that, suggesting phys diffs run their course. Midland cargoes are too expensive to land, but the problem might come from the Meds, not by EU failure, but Asia has been clearing a lot of CPC and Libyan lately, and there are signs of exhaustion already, so if these cargoes remain in the Meds, Brent diffs don’t have much more room to grow, and that sky-high diesel crack is no longer there to save us.

Brent/Ti spread is getting dangerously wide, but again, their problem..

Americas

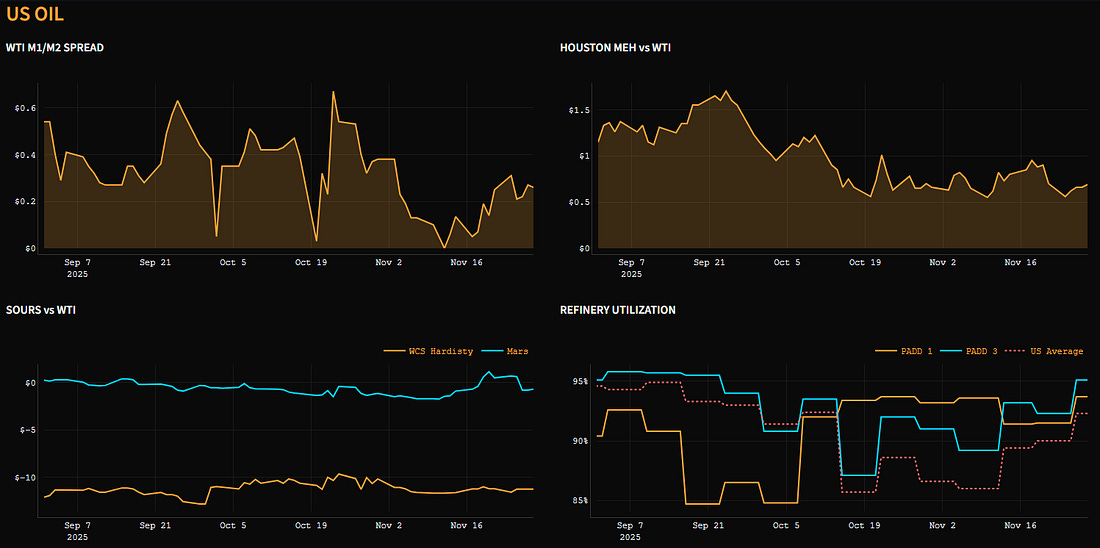

Good news: refineries are back at it, net imports are up and end-user demand is surprisingly good for this time of the year.

Bad news: that’s not enough. We are building inventories of any kind and there is no escape from that.

Problem are exports, you can throw the WTI benchmark under the bus to entice Europe, but without the Asian buyer this goes nowhere. It makes more sense to send it to inventories inland rather than market it at Brent -5. We had one cargo to India, one to Vietnam, but without Korea and Japan, despite their pledges to Trump, they are not buying any. The only activity we see is China lifting Canadian.

It will take freight to come down considerably to make this work again, but we don’t see that happening anytime soon. Guyana is now replacing WTI to China with the first Arrow Head cargo sold, arriving in Feb. Those are Exxon and Chevron cargoes anyway, so expect this to be the norm.

Could a Venezuela operation save the day here? Judging by the other heavy sours in the region, and even Mars, losing (temporarily) 150kbd won’t change things much. If regime change also brings a revamp of the trepid upstream sector, then we’ll be in trouble, but that’s a 2026 conversation.

Middle East

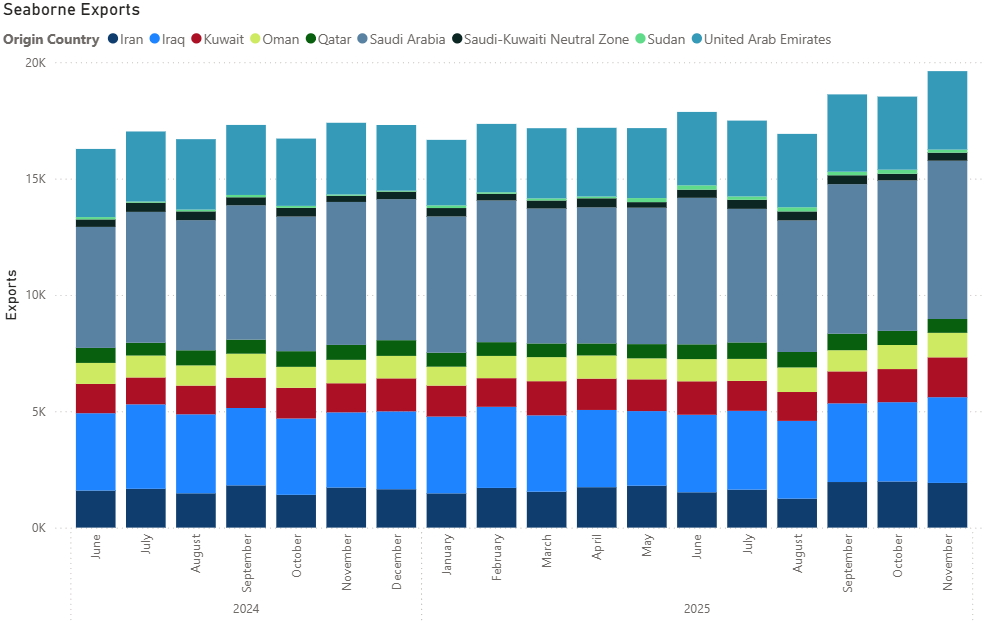

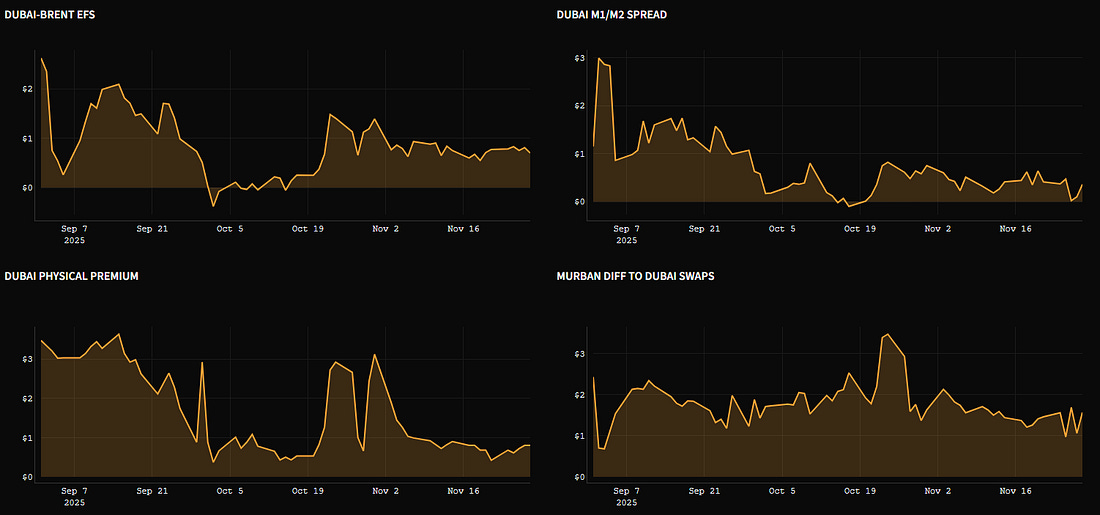

OPEC Sunday. Who cares?? look at those exports. If it weren’t for India still buying on the spot market here, we should be negative. Here is a little more difficult to ignore the oil glut, as the Dubai structure is dancing with contango.

This week we’ll see Saudi Aramco OSPs below $1, a 5-year low, but will that be enough to bring China appetite back? I doubt it, given all the choices they have now, so maybe this is the time when they give up and try to price competitively in Europe and US, they don’t have much choice.

Now, how much of the ginormous crude exports are driven by policy, rather than lack of domestic refining demand? We have Al Zour coming back, two Saudies (SATORP & SASREF) also online by mid Dec, so the balance should tighten a bit. Ras Tanura refinery, a big one, is going offline for two months in January, so there’s that as well… that will be a gasoline problem.

WAF

We had a few good days in the sun when Gasoil cracks were ripping in Europe, Nigerian grades that are richer in gasoil yield were getting to the Meds and central Europe.. until gasoil collapsed, and along came the demise of WAF premiums.

Despite IOC (India) buying 3 cargoes this week, as we stand today: 15 out of 47 Nigerian cargoes unsold, 4 Angolan out of 34 and 2 Congolese Djengo that shouldn’t even be in the spot market, as these are China’s equity cargoes. It’s bad and the culprit is freight, nothing works with these rates.

Silver lining, Angola and Nigeria January loadings are somewhat smaller. Dangote is working and pushing maintenance once more to January… until it blows up again.

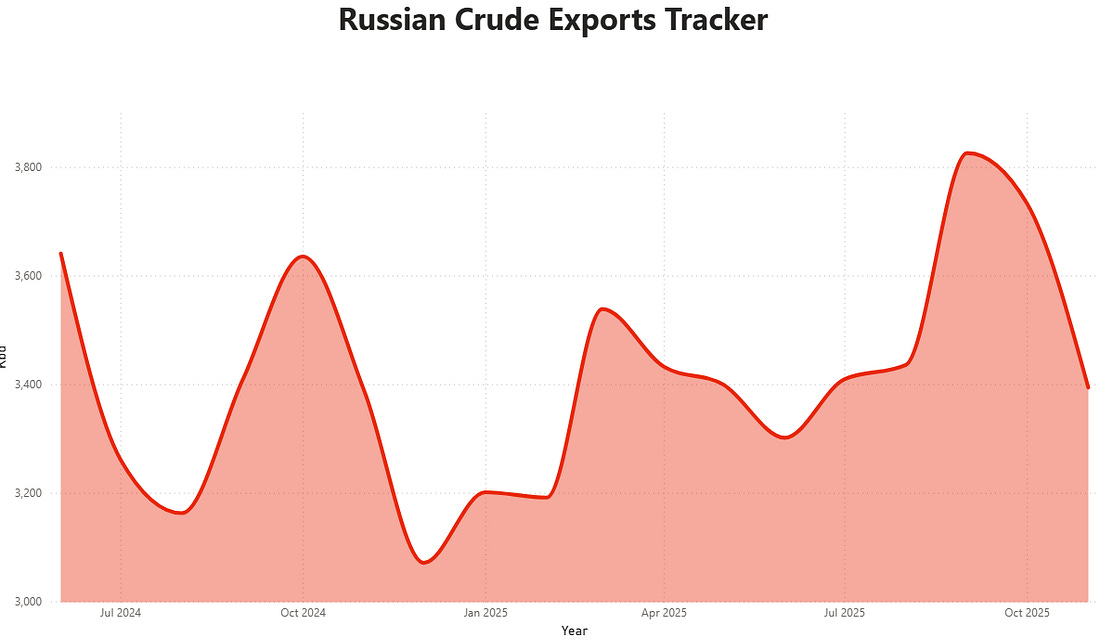

Russia

Walls are closing in. We have 1.8Mbpd arriving in India in November but Dec drops to less than 1Mbpd, Nayara, Reliance and maybe some other committed volumes, but the bulk of Indian refiners are out of Russia. Price for Urals and ESPO touched 5 year lows at -23 and -6 FOB and bounced up on the news of Chinese crude import quotas, but the truth is there aren’t enough shadow tankers to carry on at these levels of exports. Inland inventories are going up but storage is limited, storing abroad is the logical play. I put my money on Saldanha Bay tank farms in South Africa, Iran has some space for rent, but that one is also too risky.

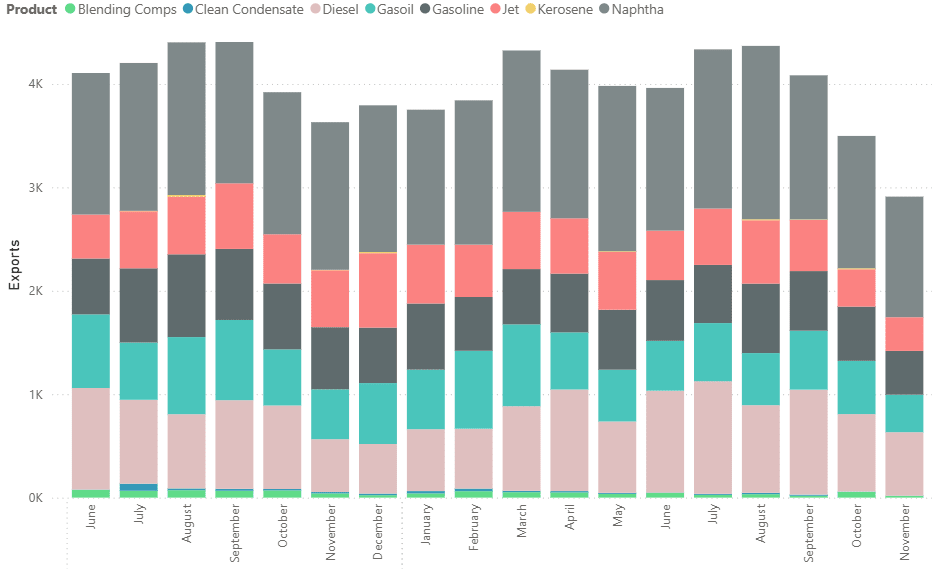

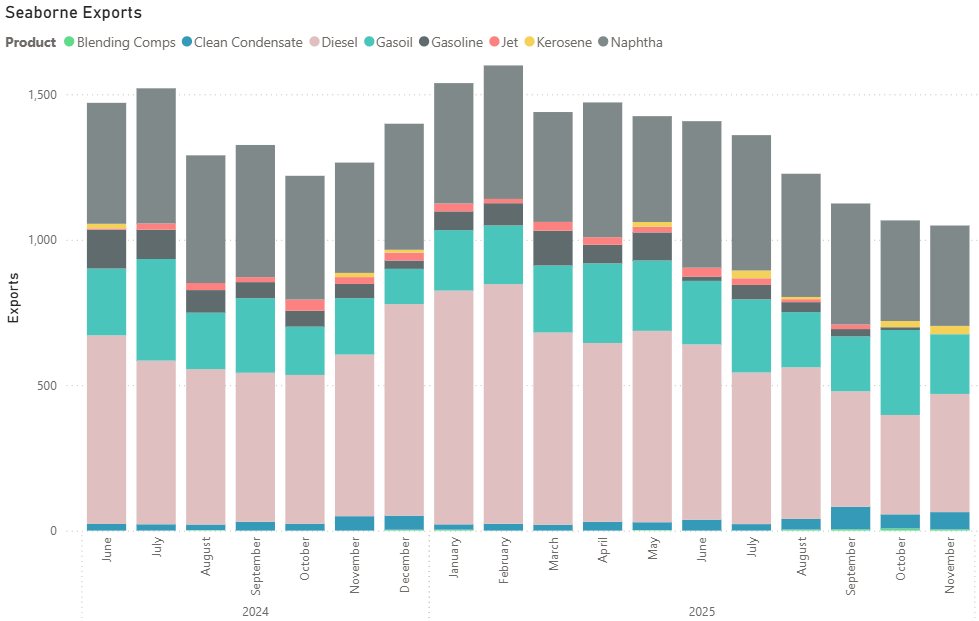

And for product exports it looks like a structural decline, those barrels aren’t coming back anytime soon.

China

We finally had the import quotas for the “Teapots” but didn’t create enough impact on the market, it is true that compared to last year they are higher but the big dogs (Rongsheng) didn’t get what they applied for, so there is some intent to frontload these quotas to clean some of the floating inventory, mainly Iranian and Venezuelan, but there is also a lot of barrels in bonded tanks, crude that has been discharged but haven’t cleared customs, so for people expecting to see a marked reduction in floating storage will have to sit this one out.

Products

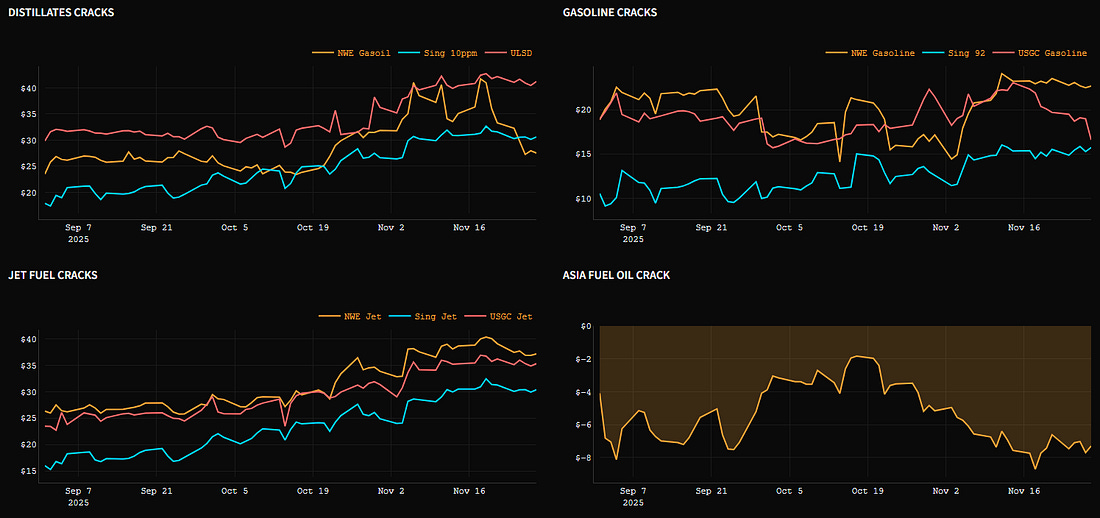

It’s over. Past few weeks we lost Gasoil in Europe and Gasoline in the US, we are still tight in distillates in Asia, which could be alleviated by the rumour of more gasoil exports from China, 700kt for Dec, while we didn’t have even half of that in the last few months.

Be it as it may, main cracks are still way above the historical for this time of the year, but the waste products, naphtha and fuel oil are awful. Eventually, those money-losing products will start to weigh on refinery margins.

Tankers

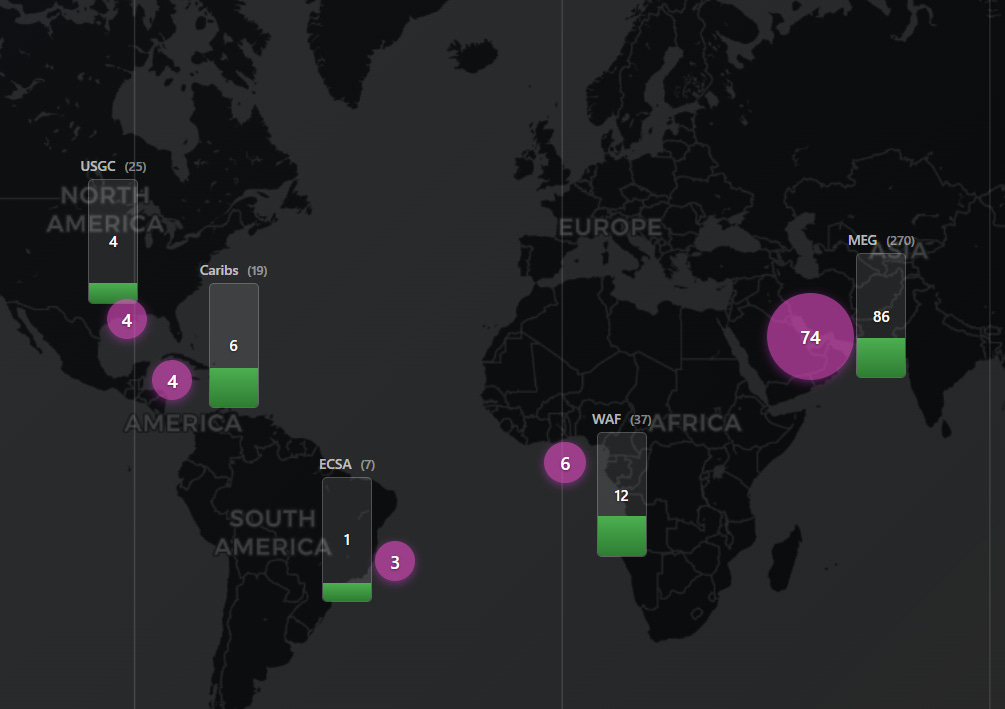

We don’t have enough VLCCs.

These are total monthly liftings for the next cycle, what we covered so far and in circles the available ships… math doesn’t check out. At these stage of tanker rallies, usually the Chinese owned tonnage tries to low-ball the market, their business is to lower the landed value, not to make money on freight, but they surrendered, we saw a few Cosco relets going for the highest bid.

For suez is not much different, CPC and Meds maxed out, India buying parcels from WAF and Latam we new crude streams are stretching the game