|

Another weekend of endless possibilities, a third consecutive week of gains in oil prices, the Brent curve steepened into deeper backwardation, differentials on fire (depending on who you ask), tanker at highs not seen since 2022 (and this time it’s everyone). Where is the oil glut we were promised? Well, It’s there… and it isn’t.

Part of this can be explained by key events we’ve been dragging along in this cycle, such as the CPC situation in the Black Sea, compounded by adverse weather that was more or less expected. But there is another component emerging, driven by shifting patterns that may well prove structural.

Venezuelan crude is slowly becoming compliant. We’ve finally seen some cargoes transact, with Trafi and Vitol acting as the ultimate executors of Trump’s will, and there is a shy interest from former buyers of this heavy crude. Repsol, Valero in PADD3, and Vitol’s own refinery in Italy have already booked March deliveries. China and India remain absent from this trade for now, simply because the economics don’t quite work yet. Price impact? Limited within the region, these cargoes are still sporadic, and at current freight rates they can’t travel very far.

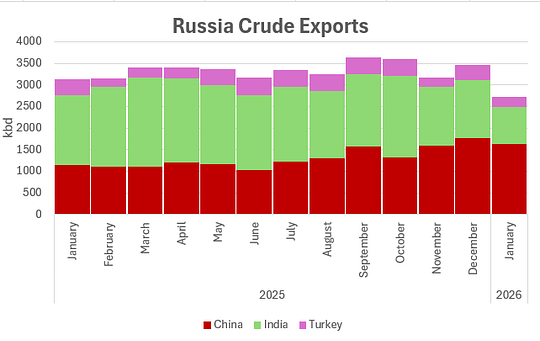

That said, one driver supporting prices across the entire structure is India’s surprising pivot away from Russian barrels. India is clearly signaling something with the abrupt drop in Urals imports. Policy design? Confusion stemming from Europe’s new segregation of Russian molecules? What is being discharged now was booked back in November, when the news first broke. Assuming a return to normal flows in February feels optimistic, to say the least. Urals FOB in the Baltic is around $36.5/bbl—the price is clearly not the issue. Trump’s threat of imposing 50% secondary tariffs is already starting to sound stale, so what’s really going on?

Reliance and Nayara will continue importing Russian crude, but state-owned oil companies are following China’s playbook. This week, India moved to lock in long-term deals with Brazil, the UAE, Oman, the Saudis, some African suppliers—in short, its BRICS partners (minus the R). This is also a way of projecting “soft power” while partially insulating itself from a turbulent Western world. The other motivation may be a genuine belief that Iranian crude will return to the mainstream market, much like Venezuela, and India would be first in line to welcome those barrels with open arms. The word here isn’t diversification, it’s optionality...

Keep reading with a 7-day free trial

Subscribe to Oil not dead to keep reading this post and get 7 days of free access to the full post archives.

A subscription gets you:

| Oil Weekly Commentary | |

| A custom App and chat | |

| We might start doing webinars |