|

While we wait for the outcomes in the Middle East, oil decided to jump on the precious metals bandwagon, which, under the convenient excuse of geopolitical risk managed to revisit the $70 handle again. That said, there were a couple of factors that turbocharged flat price higher. Price action was heavily concentrated in the March Brent contract, which just happens to expire today. That coincidence alone suggests there is more at play here than simple speculative enthusiasm.

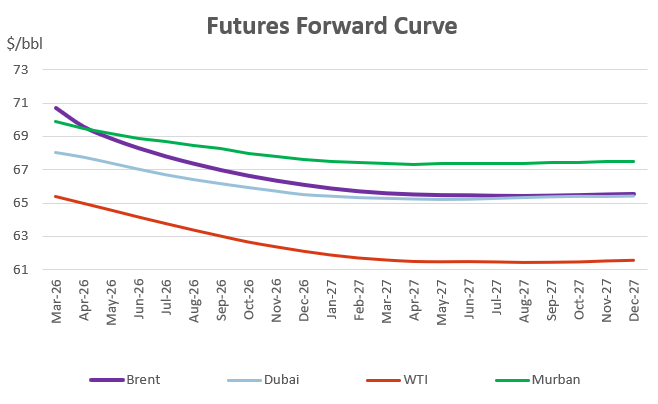

The first thing that stands out is how aggressively the futures curves steepened. Brent M1/M2 was outright obscene and is now, without question, completely disconnected from the physical market, especially with Dated Brent moving lower. One can argue this is a liquidity premium, I give you that, but I would have expected something similar in WTI, which is also highly financialized. That divergence is hard to ignore.

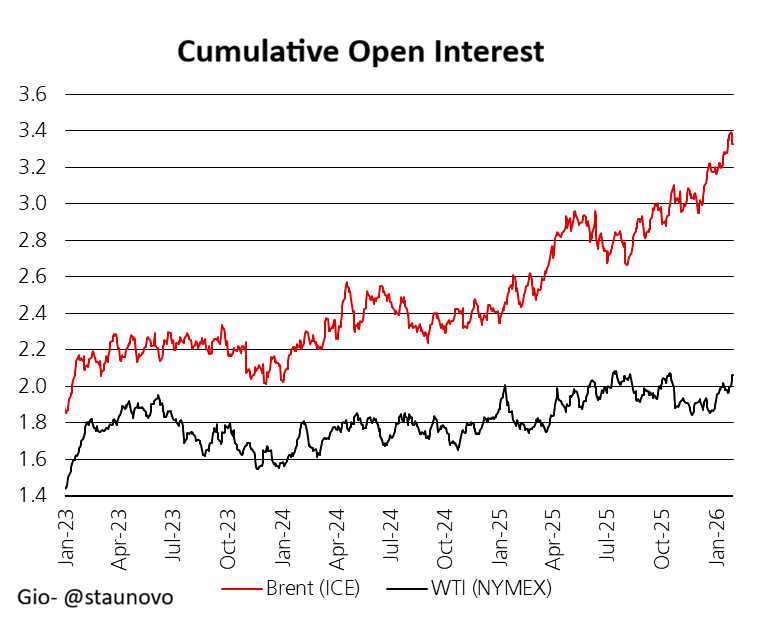

Looking at futures open interest, the increase is almost exclusively in Brent. Once again, this points to flows gravitating toward where liquidity lives. But more interestingly, it may also suggest that commercial hedgers in the U.S. did not provide the same selling flow we’ve seen in previous rallies. That could be because production has already been hedged and there is simply nothing left to sell, or because those hedges were expressed via options. On that front, however, we did not observe particularly heavy activity from the other side of the Atlantic.

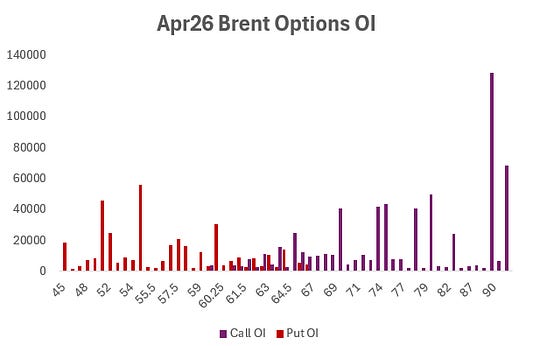

Where volume did show up in a meaningful way was in Brent options, particularly on the call side. The 90 strike now shows the largest open interest reported in several months. My first reaction, watching how fast the rally accelerated, was to assume this was driven by dealers being short ATM calls and forced to buy futures to gamma hedge as delta exploded in a single session, but no…

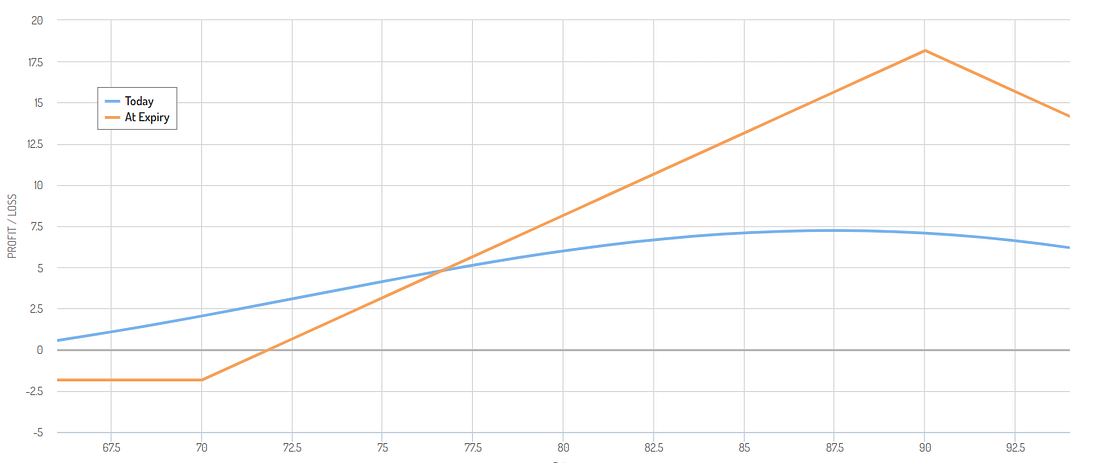

Looking more closely, that large OI sitting far out of the money points to something else: funds buying upside convexity strategies, such as call ratios. When you look at the payout profile of selling 2:1 calls at the 90 strike versus 70, it’s actually not a bad structure at all.

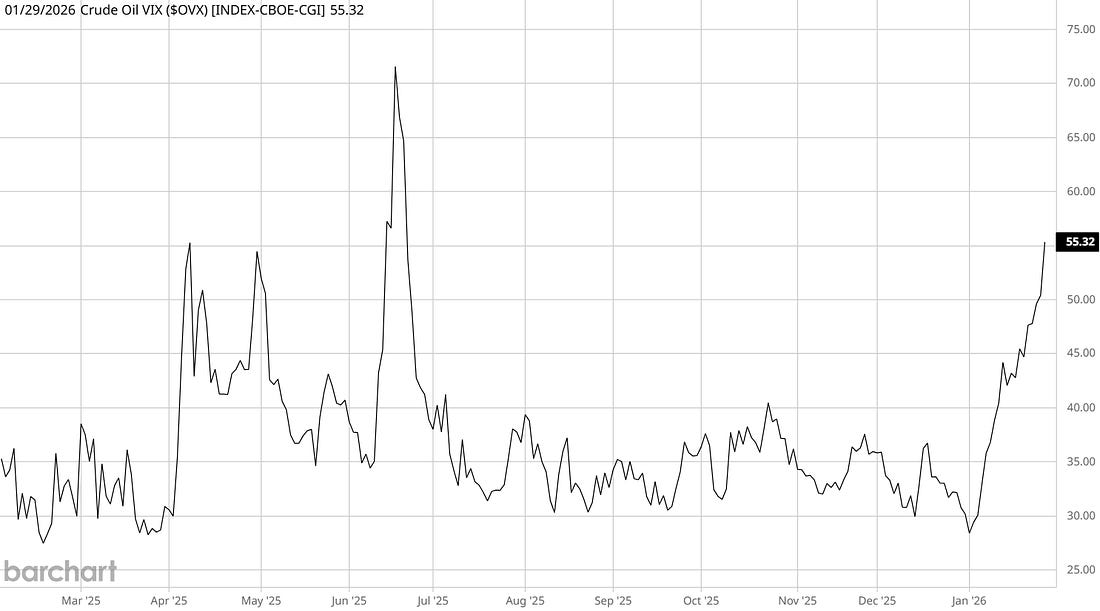

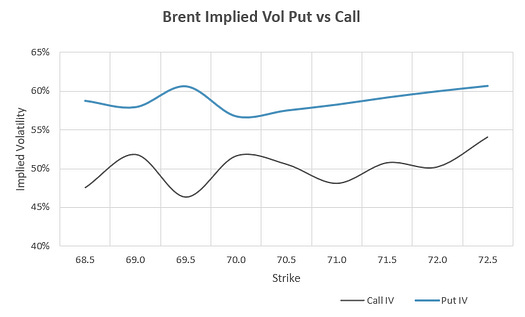

Brent option volatility also tells an interesting story. As expected, there is a clear skew toward puts, which is exactly what you would anticipate in a commodity market like oil. More intriguing, however, is the sawtooth shape of the call volatility curve. This usually signals structured trades (call spreads, ratios) and dealers warehousing selective gamma, not much outright directional call buying. There isn’t a huge amount to extrapolate from this alone, except that the market does not fully believe in this rally, which feels somewhat “manufactured” by someone else. At the same time, it does not rule out the possibility that price could still explode irrationally to the upside, in the same way we’ve seen in precious metals since the beginning of the year. This is clearly more than just selling the dollar.

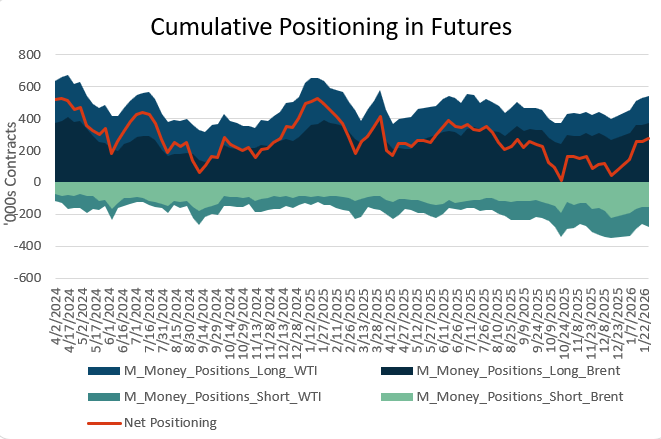

The COT picture, while only reflecting positioning up to Tuesday, already shows that net positioning has moved away from recent lows and is heading toward a more balanced stance, without reaching any kind of extreme. From a sustainability perspective, that is actually constructive.

What would worry me more is a surge in retail inflows, which so far has not really materialized despite the headlines. Gold and silver ETFs are absorbing most of the available liquidity, stealing the spotlight and the capital.

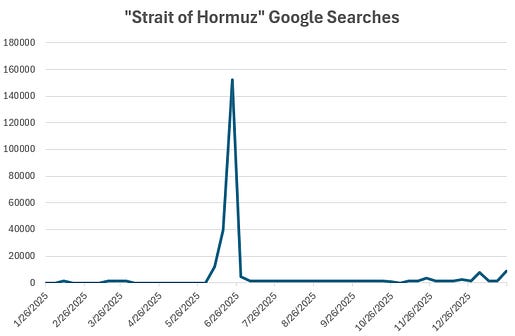

All of this makes it difficult to pin down exactly what is driving the move. Some argue that there is roughly a $5 geopolitical risk premium embedded in price, which feels excessive considering we had this exact same conversation around the Strait of Hormuz multiple times last year and we all remember how that ended.

I am more inclined to think there is something else going on beneath the surface, beyond the immediate geopolitical backdrop. Since the beginning of the year, we’ve seen a clear macro repositioning across commodities in general. I’m not sure this is purely a flight out of the dollar; it may instead be a broader rotation away from equities and fixed income into something more tangible.

Is $70 expensive? Cheap? It depends. Is $5,000 per ounce too high for gold? At some point, we start losing our sense of value altogether. What I can say is that today, any barrel priced at Dated +1.5 is expensive. An inter-month spread near $1 is expensive. But in terms of flat price? 60 or 70… at this stage, its all the same… not even producers know what to make of this.

If you want to gamble on events, oil is not your place. You already have another venue for that.

Oil Physical

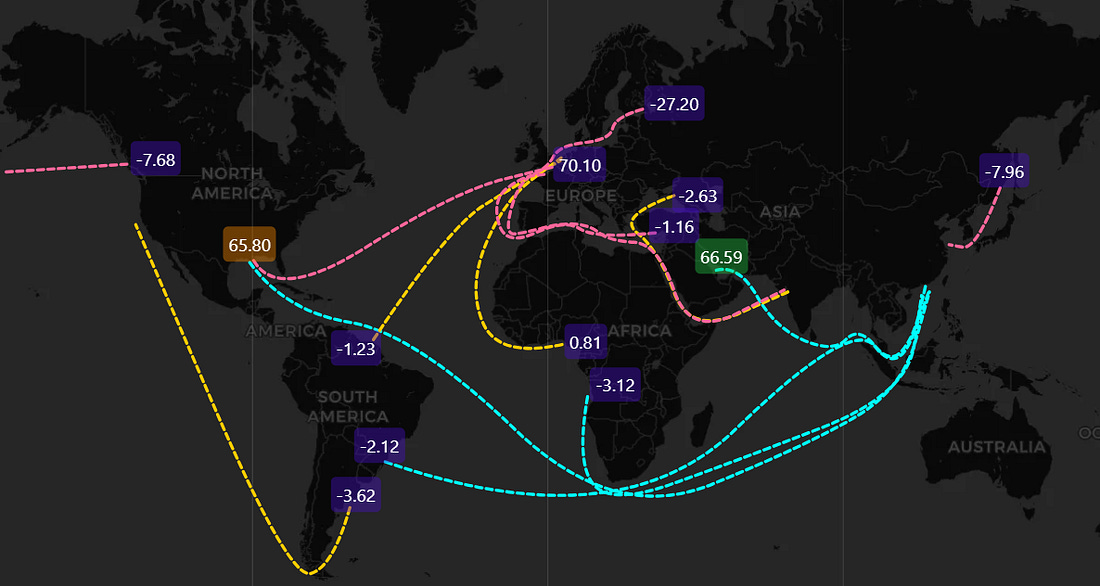

Tension release… we finally saw some readjustment in FOB markers and freight to accommodate to the next cycle, which seems to be quite heavy on the supply. Some barrels are already struggling to clear into this cycle, but the next leg down should come from the freight side, FOB diffs can only do so much. Except in North Sea, some export barrels are competing with the tanks onshore. The forward curve doesn’t allow just yet but Dubai and WTI are looking for it once the sky clears.

Keep reading with a 7-day free trial

Subscribe to Oil not dead to keep reading this post and get 7 days of free access to the full post archives.

A subscription gets you:

| Oil Weekly Commentary | |

| A custom App and chat | |

| We might start doing webinars |